Out-of-stocks: The $1.2T eCommerce inventory management problem crushing retailers

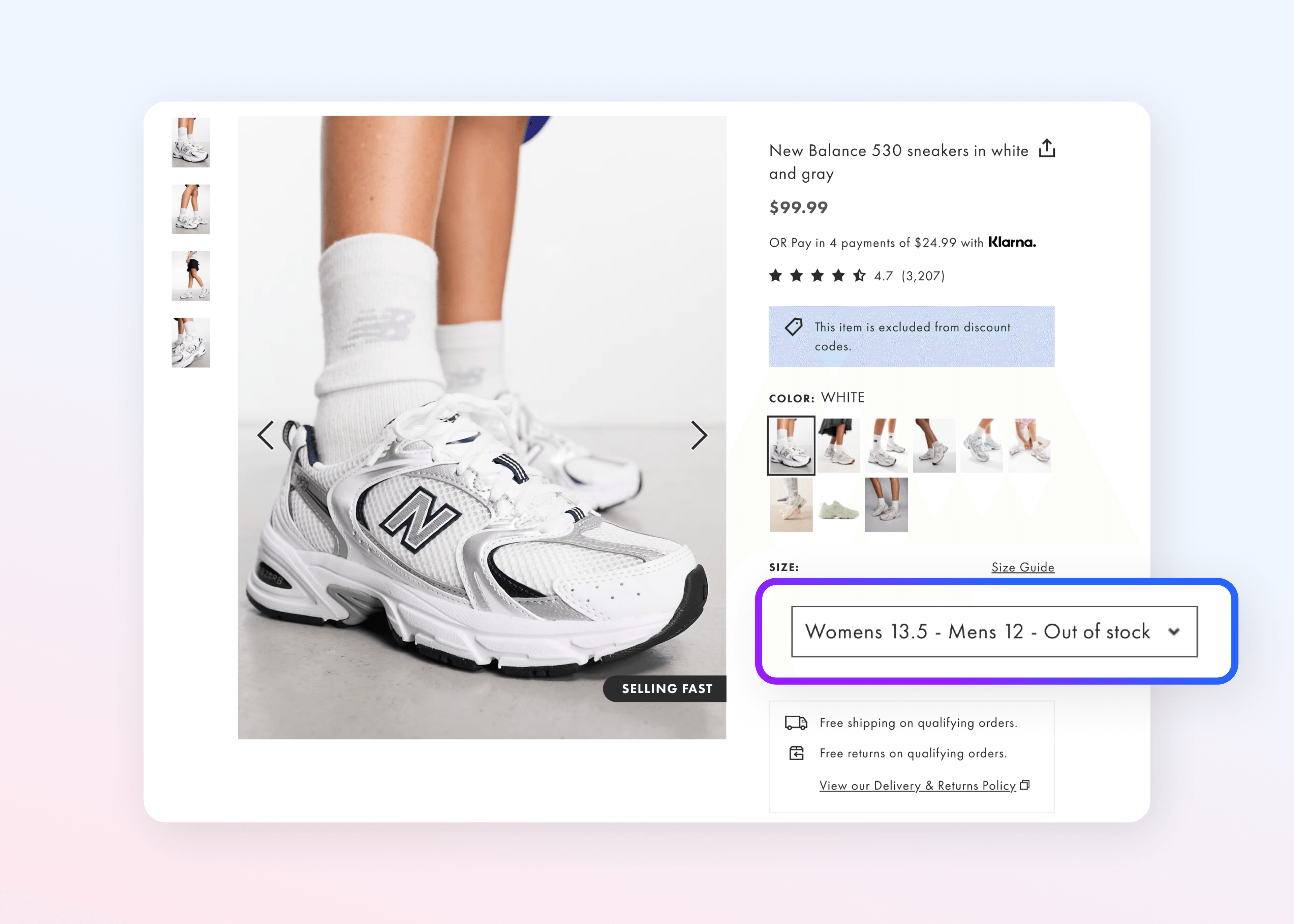

Out of stock.

The phrase is simple, but the problem it represents is one of the most complex and expensive challenges in eCommerce, today.

For retailers, an empty digital shelf doesn’t just mean a missed sale; it represents a fundamental break in the trust that these businesses have worked so hard to build with their customers.

While the issue affects retailers of all sizes, it is particularly acute for mid-sized retailers that lack the sheer scale and capital of giants like Amazon and Walmart. For these businesses, the struggle to keep popular items in stock is not a small hiccup; it is a fundamental, existential problem.

In fact, research estimates that stockouts (another term for out-of-stock items) cost retailers over $1.2 trillion annually in lost sales, a trend that has persisted for the better part of the last decade.

The data is unequivocal: This is a crisis, and traditional inventory models are failing to solve it.

A deeper look into this crisis reveals the full, hidden costs of out-of-stocks and introduces a transformative approach to solving the problem — one that frees businesses from the burden of inventory management and reignites growth.

The high cost of stockouts

The immediate financial impact of an out-of-stock item is a lost sale, but the cascading consequences are far more profound.

The Harvard Business Review has found that, when a product is unavailable, retailers lose nearly half of all intended purchases, a testament to the speed at which consumers move on to an alternative. Further, upwards of 20% of all online cart abandonments are also attributed to stockouts.

The ripple effect extends far beyond the immediate lost sale.

An out-of-stock item can eliminate an entire “basket” of potential cross-sells and upsells, reducing the overall transaction value.

Wasted marketing spend is another critical consequence. A retailer might invest heavily in digital ads and promotions to drive traffic to a product page, only for that page to display an "out of stock" message. The marketing investment is rendered useless, directly lowering its return on investment.

Furthermore, stockouts place an additional burden on customer support staff, who must field more calls, emails and follow-ups from frustrated customers, increasing operational costs.

Loading...

The unspoken damage stockouts cause a brand

Beyond the financial spreadsheet, the damage from stockouts erodes something far more valuable: customer trust.

This trust is hard to build and easy to lose. According to Accenture, 62% of consumers consider trust to be one of the most important factors when engaging with a brand — that’s up from 56% the year prior.

Repeated stockouts are a clear sign of poor brand reliability and directly impact this trust. Consistent unavailability makes a brand seem disorganized or poorly managed, signaling to customers that their needs are not a priority.

This negative perception can spread rapidly. Unhappy customers are far more likely to share their negative experiences, leading to negative word-of-mouth that can damage a brand’s reputation and deter potential new customers. In some cases, loyal customers can even be transformed into “negative advocates” spreading their frustration to friends, family and social media networks.

Another often-overlooked consequence of out-of-stocks is the SEO penalty.

Hiding or removing out-of-stock product pages can lead to 404 errors, which search engines penalize, negatively impacting a site’s search ranking.

This creates a vicious cycle where lower visibility leads to fewer potential sales, pushing the brand further down search rankings and giving competitors an even clearer edge.

Why traditional inventory management is failing

The out-of-stock crisis is fundamentally rooted in flawed internal processes and a fragile supply chain.

Traditional inventory models, built for a less complex era of commerce, are ill-equipped to handle the complexities of modern consumer demand and supply chain volatility.

One of the most significant problems is inaccurate forecasting.

Inaccurate forecasting is a problem so widespread that Gartner estimates that less than 50% of sales leaders and sellers have high confidence in forecasting accuracy.

The margin of error that exists in inaccurate forecasting leads directly to the core problems of inventory distortion: when demand is underestimated, stockouts occur, and when it is overestimated, overstocks accumulate.

Furthermore, inaccurate inventory records, often caused by human error, miscounting or a lack of real-time updates across multiple sales channels, are a leading cause of stockouts.

The marketplace model: Solving out-of-stocks and catalyzing growth

Loading...

The solution to out of stocks lies not in tweaking a broken system, but in a fundamental re-architecture of the business model — one that decouples inventory ownership from sales.

In a traditional model, a retailer takes on all the financial risks of purchasing, storing and managing a large volume of stock. The marketplace model, in contrast, shifts the duty and burden of inventory management to a distributed network of third-party sellers.

This strategic change enables a retailer to offer a “limitless aisle” of products without making any capital investment in the stock itself. This is particularly evident in dropshipping, where a retailer simply forwards an order to a supplier who handles the storage and fulfillment.

This strategic shift frees up capital for more productive and profitable ventures, such as brand-building, marketing and enhancing the customer experience. The marketplace model also offers a more robust solution to the problem of out-of-stocks by functioning as a large-scale Vendor-Managed Inventory (VMI) system, where a network of sellers is responsible for managing their own stock and ensuring product availability.

The model’s decentralized nature provides a powerful buffer against supply chain shocks and demand spikes. When one seller runs out of a popular item, the marketplace can leverage another seller in the network to fulfill the order. This distributed fulfillment capability provides a level of resilience that a single-warehouse model simply cannot match.

This fundamental re-architecture of the business model enables a company to move from a reactive, capital-intensive and risk-prone inventory strategy to a proactive, capital-efficient and resilient one.

The retailer’s core competency shifts from being a “warehouse manager” to a “brand curator.” They can now focus on what truly differentiates the brand — the customer experience, product assortment and marketing — while their partners handle the complex and risky operational aspects of the supply chain.

Loading...

Learn more about avoid stockouts with the right marketplace tech

The data is unequivocal: Stockouts are costing the global retail industry trillions of dollars annually, and is a problem that traditional inventory management methods are ill-equipped to solve.

The marketplace model is not just a solution to out-of-stock challenges, but a powerful engine for modern eCommerce growth. It empowers businesses to solve a persistent business problem while building a more resilient, agile and profitable enterprise.

To learn more about how the right marketplace tech can transform a business, watch our on-demand conversation with industry experts Bain & Company and Cheney Brothers, here.

Watch on-demand: How to turn marketplaces and dropship into a profit engine

Other sources

New research on search abandonment in retail | Google Cloud Blog

The Impact of Stockouts on Customer Loyalty to Lean Retailers