Why retailers are leaking market share to Amazon and Walmart (and how to fight back)

Retail is evolving at breakneck speed, but one thing remains constant: anxiety that Amazon’s and Walmart’s relentless expansions will continue unchecked, as these tech giants sweep up market share with seeming impunity.

The greatest challenge for retailers comes from the fact that Amazon and Walmart aren’t just traditional competitors. They’re ecosystem builders — platforms that connect buyers, third-party sellers, logistics, payments and advertising in a way that makes them indispensable to both shoppers and other businesses. They’re not playing the same game as everyone else; they’re rewriting the rules of eCommerce.

This shift has created a suffocating squeeze on mid-sized retailers, who can’t match the scale, selection and convenience of the giants, but also can’t offer the hyper-local experiences of small independents. The pressure, especially in today’s uncertain economic climate, has left many struggling just to survive.

Unfortunately, the solution isn’t as simple as starting a price war. Rather, it’s rooted in overcoming three critical operational vulnerabilities.

The three core operational vulnerabilities hurting eCommerce businesses

Out-of-stocks, product data/image quality and limited product assortments are three key operational weaknesses Amazon and Walmart have already solved, but which are quietly eroding customer loyalty across the mid-market. Here, we’ll discuss those vulnerabilities and how forward-thinking retailers transform them into strengths.

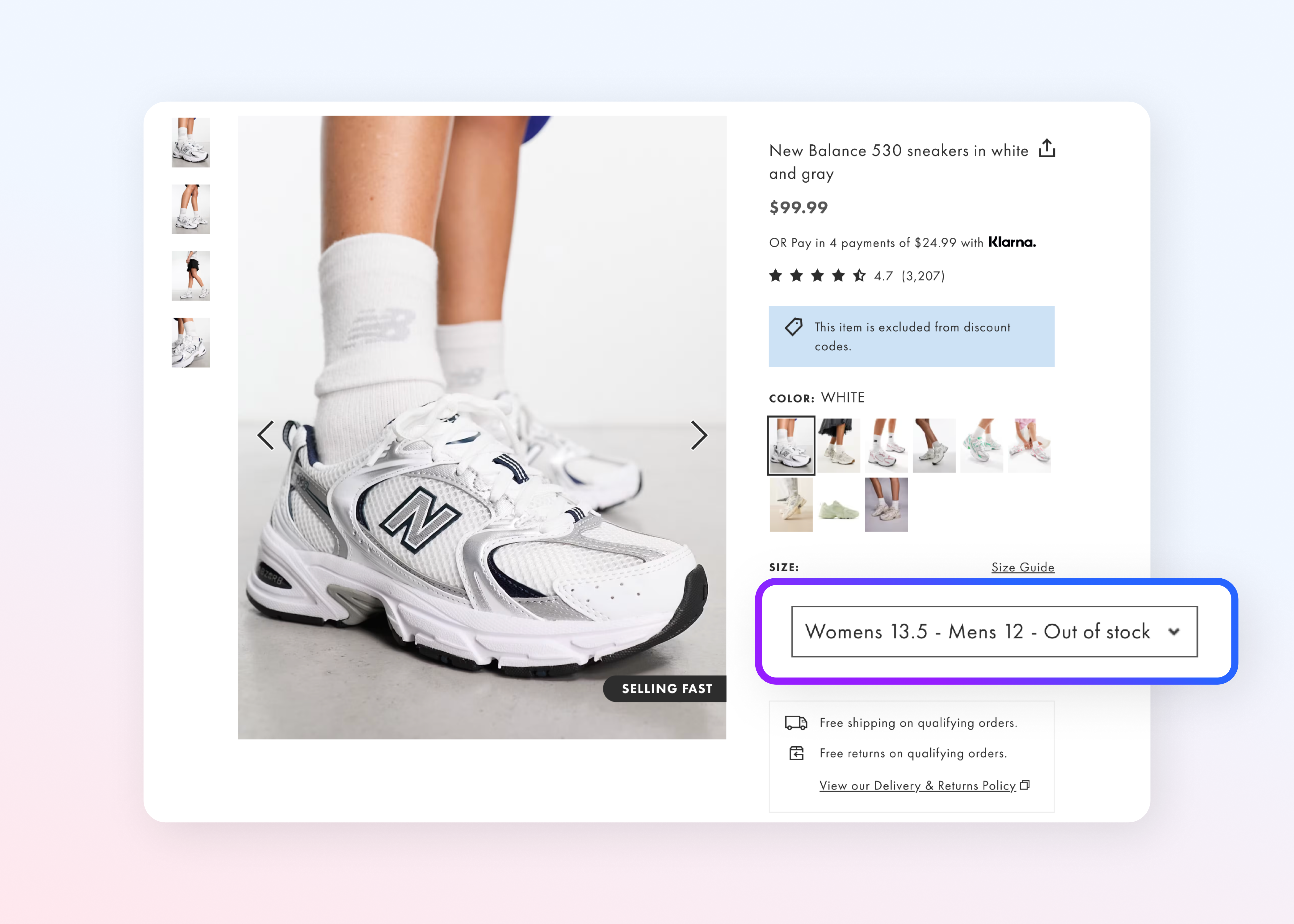

Vulnerability 1: Out-of-stock means customers can’t get what they need and want

Out-of-stock (OOS) issues are particularly painful because they typically result in your customers shopping elsewhere — as consumers today are unlikely to wait for a restock when the item is readily available on a competitor's website.

According to IHL, who has tracked inventory distortion for nearly two decades, retailers lost roughly $1.2 trillion to OOS issues in 2024 alone.

Mid-sized retailers took the brunt of that hit, as they face the constant challenges of inaccurate forecasts, supply chain hiccups and limited storage. These constraints lead to frequent OOS, further hampered by legacy systems and fragmented supplier relationships.

But OOS isn’t inevitable. It’s a symptom of an outdated operating model, and so fixing it means rethinking inventory strategies and empowering your business to serve customers reliably, every time.

This is where Amazon and Walmart excel.

These giants have mastered inventory management with vast supplier networks, advanced forecasting and marketplace or dropship models which allow them to minimize OOS, especially on must-have items.

This ecosystem, powered by their marketplace, is what allows them to quickly source products from multiple partners, keeping their digital shelves stocked.

Vulnerability 2: Poor product data and image quality lead to distrust and lack of conversions

If your website is your digital storefront, then your product detail page is your digital salesperson.

But what good is a salesperson if they can’t answer the shopper’s most relevant or pressing questions? How many sales can someone make if they can’t properly show or demo the product they’re trying to sell?

Poor data — in the form of missing specs, fuzzy images or inaccurate descriptions — only leads to shopper confusion, along with an increase in returns and cart abandonment. It also fosters distrust among consumers and ultimately diminishes your brand, resulting in poor customer loyalty.

That means great product pages aren’t optional, but essential.

Amazon and Walmart have dominated eCommerce, in part, because they’ve set the standard for product content. Their strict data requirements and powerful infrastructure ensure every detail is clear, accurate and visually compelling, in order to build trust and make conversions nearly effortless.

Further, the rise of AI in retail means consumers are leveraging new channels to make high-context searches with LLMs that prioritize surfacing detail-rich results — and will likely ignore products with low-quality and/or missing data.

It’s a good reminder that investing in data quality isn’t just about aesthetics; it’s a direct lever for revenue, lower returns and lasting customer trust. And it just might help you future-proof your marketplace against the AI revolution.

Vulnerability 3: Lack of product assortment limits appeal among current and future customers

Are you a backup plan or the main destination for your shoppers?

Today’s customers expect choice in their online shopping experiences. That means both breadth and depth of product assortment that allows them to shop for both everyday essentials and unique finds in a single place.

When shoppers can’t find what they want with you, their shopping experience becomes fragmented as they're forced to look elsewhere — driving down loyalty and turning your shop into a backup plan.

Unfortunately, traditional models, shaped by physical constraints and cautious buying, force tough decisions about what to stock. Amazon’s and Walmart’s marketplace models means they’re not similarly constrained.

Rather their marketplace models mean nearly infinite assortment, with the ability to test new categories and meet niche demand without inventory risk.

It’s what’s allowed them to become a one-stop shop, capturing more share of wallet and loyalty in the process.

The cumulative impact: The loyalty chasm

These vulnerabilities don’t operate in isolation. Together, they create a “loyalty chasm,” or the widening gap between what shoppers expect and what many retailers deliver.

Ultimately, if you can’t provide the right product, with clear information and ample choice, you give customers no reason to stay. They’re empowered to find a better experience elsewhere, and today that usually means Amazon or Walmart.

The path forward: Transforming operational vulnerabilities into eCommerce strengths

While every retailer today is engaged in a fight for market share with Amazon and Walmart, it’s also important to recognize that the two tech giants have effectively laid bare the blueprint for success in eCommerce.

The squeeze from the giants is intense, but so is the opportunity for retailers ready to adapt. The answer isn’t to out-Amazon Amazon, but to leverage the strategies that powered their rise, tailored to strengthen your brand and your customer relationships.

With that in mind, the path forward is an embrace of the platform model.

A platform approach — be it marketplace or dropship — lets you transform pain points into advantages by:

Solving out-of-stock: Connect with a larger network of sellers and suppliers for better inventory visibility and resilience. When you can reliably deliver, you build trust and loyalty.

Enhancing product data: Enforce data-quality standards and streamline how you ingest content from multiple sources. High-quality, consistent product information fosters confidence and repeat business.

Expanding assortment: Marketplace and dropship models let you dramatically grow your catalog, without taking on inventory risk, making your site a true destination.

Operating your own marketplace gives you control over your brand and customer loyalty programs. Unlike selling on Amazon, building your own platform allows you to maintain ownership of your brand, customer relationships and data. This is crucial for fostering deep and lasting customer loyalty.

How the right eCommerce platform can help you regain market share against Amazon and Walmart

The threat of market share loss is real and growing, driven by shifting customer loyalty and the relentless expansion of Amazon and Walmart.

But there’s still time to act.

By addressing these core operational vulnerabilities and embracing modern eCommerce strategies, like marketplace and dropship models, you can stem the tide, rebuild customer loyalty and position your business for long-term success.

The right eCommerce platform can make it easy to adopt such a strategy and unlock unprecedented growth. In fact, retailers that leverage Mirakl grew 6X faster last year vs the competition — and saw a 34% bump in GMV over Black Friday and Cyber Monday, alone.

Learn more about how the right platform and strategy can help you accelerate eCommerce growth by downloading our eBook, here.

Download eBook: How marketplace and dropship accelerate eCommerce growth