In a sea of tariffs, the marketplace is proving a lifeline for retailers

The currents of international trade are increasingly turbulent.

A recent surge in tariffs and shifting trade policies has created a challenging landscape for retailers worldwide.

The sheer frequency of these changes adds another layer of complexity. In the last few months alone, new or revised tariff policies were announced more than 50 times. This rapid succession of adjustments, described by economists as unprecedented, underscores the instability retailers face.

This environment translates into significant operational headwinds like the rising costs of goods, unpredictable supply chain disruptions and a pervasive uncertainty about what tomorrow might bring. For many, these challenges are not just obstacles but existential threats.

In these choppy waters, however, a beacon of resilience is emerging. The marketplace model, once perhaps a secondary consideration for some, is now proving to be a crucial lifeline. It offers a strategic pathway not just for survival but for sustainable growth and a distinct competitive advantage — leading to top retailers investing more heavily in tech to support it.

When traditional retail models capsize

Retailers heavily reliant on traditional, linear supply chains, particularly those dependent on single-source imports, are finding their vessels taking on water.

Consider the current predicament of a large-scale retailer — let's call them "Global Goods Inc."

For years, Global Goods Inc. thrived by sourcing over 90% of its diverse first-party (1P) product catalog from China — the country perhaps hit hardest by the United States recent tariff policies.

This strategy, once a cornerstone of their success, has now become their Achilles' heel. Hit hard by successive waves of tariffs, the company has seen its import costs skyrocket, forcing them to pause significant supply lines. Their 1P business, the traditional engine of their revenue, is now struggling to stay afloat.

This scenario starkly illustrates the vulnerabilities inherent in the traditional 1P retail model amidst the current trade climate, including:

Direct exposure to cost volatility: Tariff increases and fluctuating import duties directly impact the bottom line, squeezing margins or forcing price hikes that can alienate customers.

Inflexibility in sourcing: Decades-old supply relationships, while once valuable, can become rigid chains, making it difficult to quickly pivot sourcing to new countries or suppliers.

Risk of empty shelves: Import disruptions, whether due to tariffs, port congestion or geopolitical uncertainties, can lead to stockouts, unfulfilled orders and deeply dissatisfied customers.

Burden of owned inventory: Retailers bear the full financial risk of inventory that may become too expensive to sell profitably or impossible to replenish predictably.

Anchoring your business in resilience

Faced with these headwinds, the marketplace model offers a more robust and adaptable vessel.

For retailers who have already embraced a marketplace strategy, now is the time to invest further, transforming it from a supplementary channel into a core pillar of their business.

The inherent structure of a marketplace provides several key advantages in navigating tariff-induced storms, such as:

Diversified supply: A marketplace, by its very nature, hosts a multitude of third-party (3P) sellers, often from diverse geographical locations. This built-in diversification means less reliance on any single country or trade agreement, mitigating the impact of targeted tariffs.

Reduced inventory burden and risk: In a marketplace model, 3P sellers typically own and manage their inventory. This significantly reduces the retailer's direct financial exposure to tariff-related cost increases and the risks associated with holding large amounts of potentially impacted stock.

Agility and adaptability: When import disruptions affect certain products or suppliers, a marketplace allows retailers to rapidly onboard new sellers and alternative products. This agility ensures a continuous flow of offerings, filling gaps that might otherwise appear in a 1P model.

Revenue diversification through take rates: Marketplace revenue is primarily driven by a commission, or "take rate," on sales made by third-party sellers. This model, often seeing take rates in the 11-15% range, provides a more stable and predictable revenue stream that is less directly tied to the fluctuating costs of goods.

Maintaining product availability: The "empty shelves" syndrome plaguing traditional retail becomes far less of a threat. A vibrant, well-managed marketplace can ensure that even if some 1P supply chains are strained, customers still find a rich and varied assortment of products.

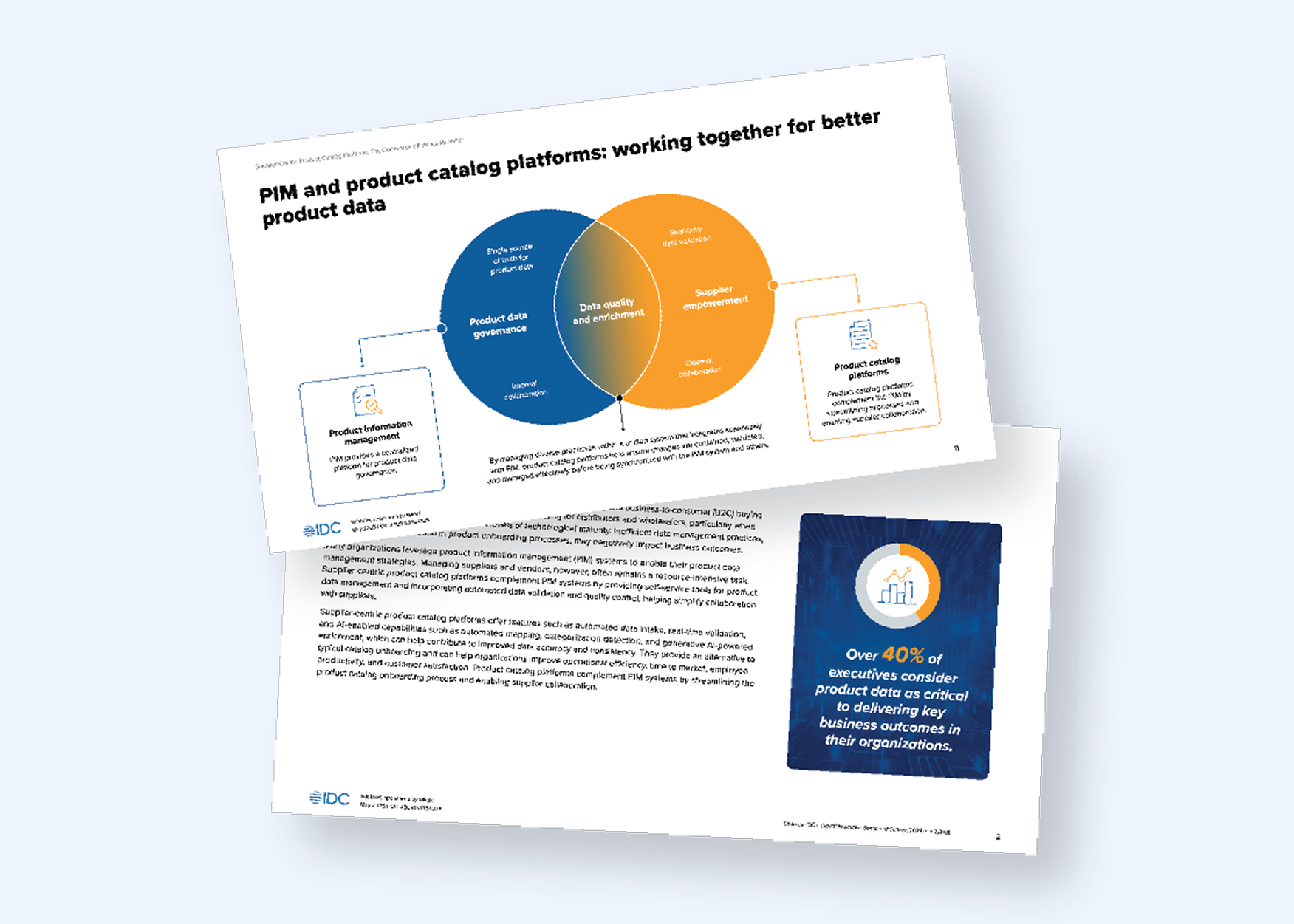

Mirakl Catalog Solutions: A compass and crew for marketplace success

For retailers looking to expand their marketplace offering in response to these challenges, powerful tools are essential.

Mirakl Catalog Solutions are engineered to provide the control and scalability needed to navigate this expansion successfully. Investing in and optimizing your marketplace with solutions like these has become a strategic imperative.

Here’s how Mirakl Catalog Solutions empower retailers to master their marketplace amidst tariff uncertainties:

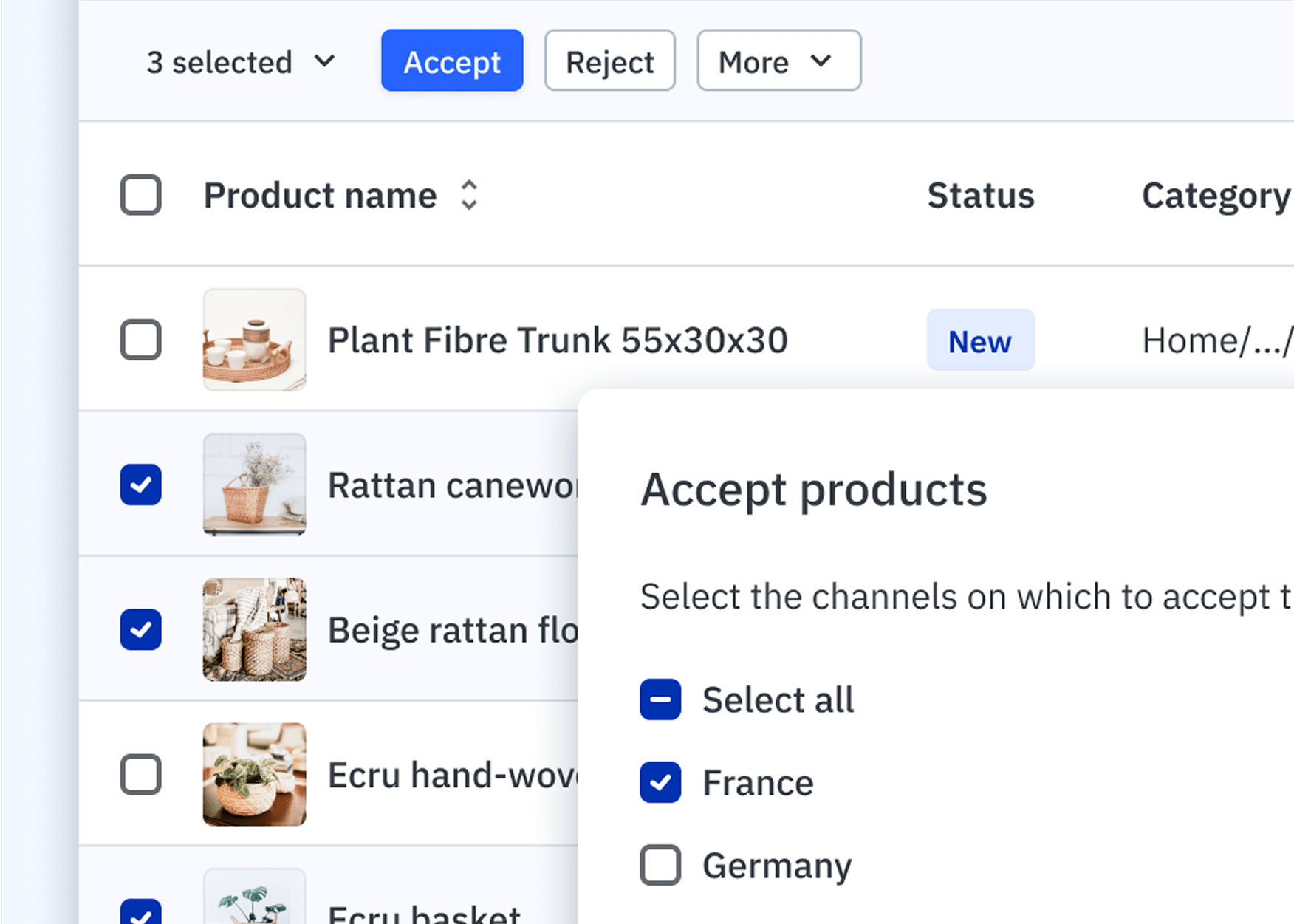

Rapid seller onboarding: In an environment where sourcing agility is paramount, Mirakl streamlines and accelerates the process of integrating new 3P sellers. This capability is crucial when needing to quickly pivot and onboard sellers from different regions or those offering alternative products to counteract tariff impacts.

Maintaining brand control and consistency: Expanding a seller base rapidly can risk brand dilution. Mirakl provides robust tools to ensure that all product listings meet brand standards, data quality is high, and the customer experience remains cohesive and positive, regardless of the product's source.

Efficient catalog management at scale: As the number of sellers and products grows, so does complexity. Mirakl Catalog Solutions are designed to handle the intricacies of managing vast and varied catalogs from numerous sources, ensuring data accuracy, consistency and an easily-navigable customer experience.

Strategic inventory decisions: Mirakl provides insights that can inform critical decisions about product assortment. Retailers can analyze which 1P products are heavily impacted by tariffs and identify opportunities to transition these to marketplace offerings. If the decision is to convert existing 1P vendors to marketplace sellers, or to onboard new sellers for these products, Mirakl Catalog Solutions facilitate this transition efficiently.

Charting a new course: Realizing the potential of your marketplace

Let's revisit our anonymized retailer, Global Goods Inc. Faced with a struggling 1P business due to tariffs, they made a strategic decision: to significantly invest in and expand their existing marketplace.

This wasn't just a minor course correction; it was a fundamental shift in their business strategy. As a result of this shift, their internal forecast for marketplace gross merchandise value has been revised upward from $5 million to $8 million.

More importantly, the revenue generated from their take rate is now viewed as a primary driver of profitability, offering a more resilient income stream than their tariff-battered 1P sales.

This pivot is supported by internal realignments, with increased resources allocated to the technology and finance teams dedicated to marketplace growth.

As a part of this, one key strategy being actively pursued is the conversion of some of their long-standing 1P vendors into marketplace sellers. This allows Global Goods Inc. to maintain product availability and customer loyalty for key items, even if the sourcing and financial model has changed.

The marketplace lifeline: Why now, why Mirakl?

Historically, the marketplace model's widespread adoption may have been hindered by the availability of inexpensive imports, high margins on 1P goods, and a perception of marketplaces as experimental with limited executive support.

The current tariff environment has fundamentally altered this calculus.

What was once a strategic option is now a strategic imperative. The instability and rising costs associated with traditional global sourcing have exposed the risks of over-reliance on 1P models. Leading retailers have long recognized the power of the marketplace model and have integrated it into their core strategies, demonstrating its viability and benefits for resilience and growth.

Furthermore, history suggests that investing in technology and strategic adaptation during periods of economic pressure can yield significant long-term advantages.

For example, substantial tech investments made during the Great Recession helped fuel over a decade of growth for the tech industry. Similarly, investing in your marketplace platform during these turbulent times can position your business for sustained success and market leadership long after the current tariff storms have passed.

Navigating this shift requires expertise, technology and a strategic partner who understands the complexities of marketplace scaling. Mirakl provides the proven platform and deep industry knowledge to help retailers not only launch but also rapidly expand and optimize their marketplaces.

To learn more about how marketplaces can be a lifeline during the turbulence of tariffs — and how Mirakl can help facilitate this success — contact us today.