Defending the parts business: Strategies to stop margin erosion from cheap alternatives

The aftermarket represents one of manufacturing's best-kept profit secrets. Parts sales often deliver gross margins above 30% and aftermarket services generate around 25% EBIT, compared to just 10% for new equipment, according to McKinsey. But this goldmine is under siege.

Customers are abandoning traditional channels at an accelerating pace, a trend we first first began to see accelerate at the end of 2023, as dealer share of visits dropped from 35% to 30% in just two years.

Research from Microsoft shows a direct line between poor service experiences and an increase in customers terminating their service relationships with OEMs.

Meanwhile, eCommerce's share of parts sales — currently just 5% to 10% — is expected to at least double by 2030 as service aggregators steer demand toward whoever makes buying easiest, according to BCG.

The shift is clear: customers demand speed and simplicity now more than ever. It has become imperative for OEMs to find better ways of servicing their customers.

Why cheap alternatives are winning

The real threat isn't always the price; the deeper problem is what happens when customers can't easily buy genuine parts in the first place.

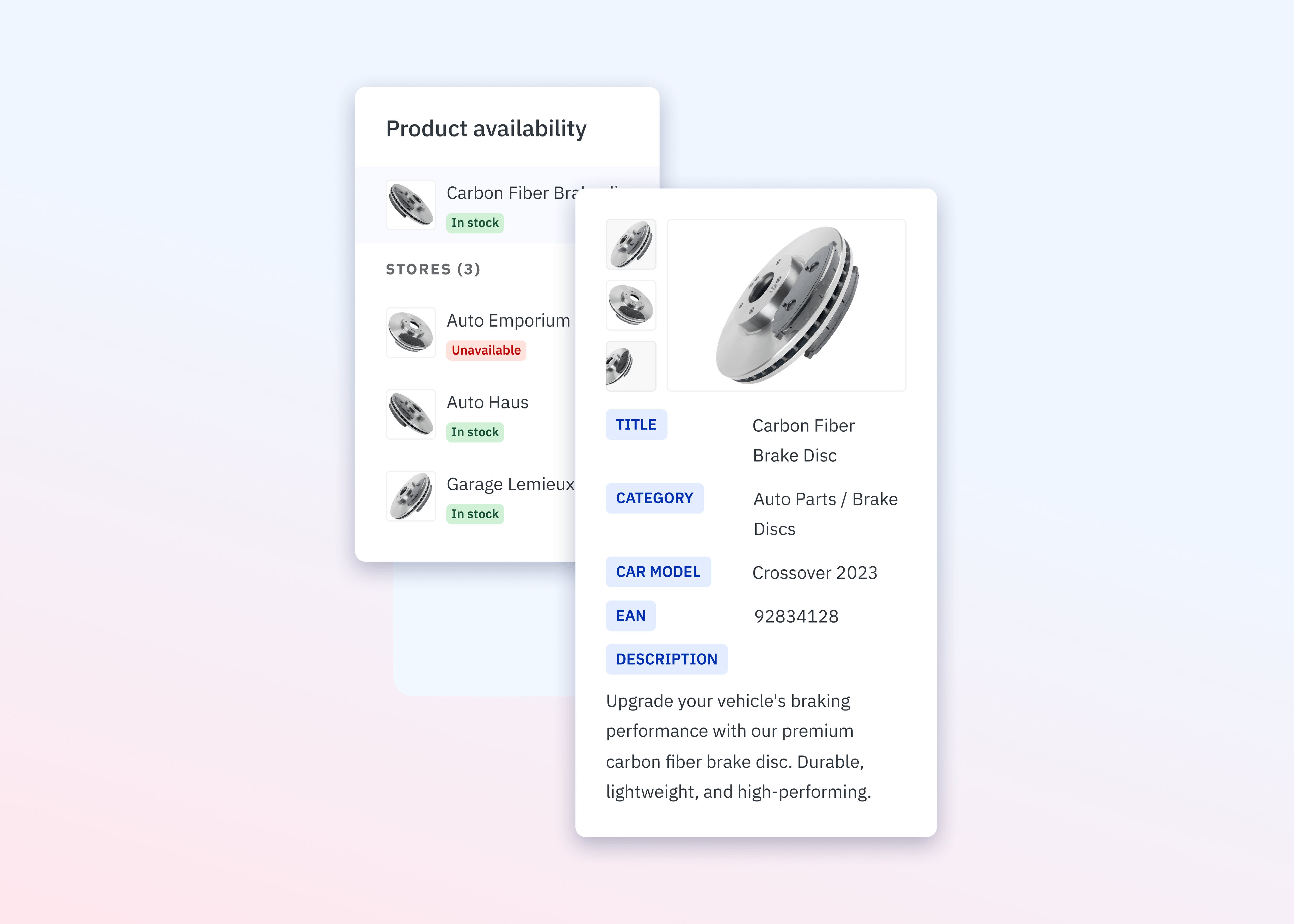

Picture a typical scenario: equipment breaks down, and a technician visits the manufacturer's website looking for spare parts. Instead of finding a product page with current information on stock availability and pricing, they encounter a basic dealer locator that provides contact information but no inventory visibility.

This forces them into a frustrating manual process of calling multiple dealers, waiting on hold and explaining the same requirements repeatedly, only to discover most don't have the needed component in stock.

At that point, even inferior alternatives become attractive. Counterfeit parts alone cost EU manufacturers around €2.24 (~$2.62) billion in direct sales annually, in categories like tires and batteries, according to the EUIPO.

When genuine parts are hard to find or slow to source, customers naturally gravitate toward whatever's available, even if it means compromising on quality or warranty protection.

Small and mid-sized dealers compound this problem. While they understand local markets and maintain strong customer relationships, many lack the resources to build comprehensive eCommerce platforms.

This digital divide creates inconsistent experiences across dealer networks. When dealers are out of stock, they often recommend competitor alternatives to maintain customer relationships, inadvertently steering business away from genuine OEM parts.

The stakes rise further for enterprise maintenance, repair and operations (MRO) buyers, where uptime outweighs price of the spare parts. These buyers need guaranteed availability, site-by-site delivery windows and the ability to purchase via PO in eProcurement systems.

A five-lever strategy to stop margin erosion from cheap parts alternatives

Forward-thinking manufacturers are fighting back with a coordinated approach that makes genuine parts the easiest, safest and smartest choice.

This strategy works across five key levers:

Availability: Aggregate inventory across dealers and OEM depots to show real-time parts availability with reliable delivery promises. Focus on high-failure SKUs and long-tail coverage to minimize those costly "first-attempt" stockouts that send customers elsewhere.

Access: Replace traditional "dealer locator" or "where-to-buy" pages with seamless "here-to-buy" experiences. Centralize catalogs on a genuine parts platform with fitment data, exploded diagrams and data sheets that help buyers find exactly what they need.

Transactions: Transform the digital destination from a sophisticated online catalog into a place where buyers can actually transact. Enable add-to-cart, checkout and payment for parts and accessories. Support common payment methods and taxes, present delivery options at checkout, and provide order status and tracking.

Account-based buying: Guide customers to the right solution, not just the right SKU. Offer job-based kits, technician tips and intelligent recommendations that improve first-time-right rates. Bring offline relationships online with contracted pricing, purchase order checkout, standard payment methods and approval workflows.

Expand assortment and value: Start with genuine parts and accessories, then use buying patterns and search data to thoughtfully add complementary third-party products that meet OEM standards. This transforms the destination into a reliable one-stop shop. Where appropriate, present clear product ladders — new, refurbished, remanufactured and job-ready kits — to demonstrate value beyond simple price comparisons.

How to modernize the parts experience without destroying dealer relationships

The key insight is that manufacturers don't need to choose between going direct and preserving dealer relationships.

A unified here-to-buy destination provides the solution — keeping dealers at the center of fulfillment, while enabling manufacturers to control the customer experience and capture valuable data.

Instead of basic dealer locators, manufacturers create a transactional platform where dealers become the sellers, handling fulfillment while the OEM controls the experience and captures customer data.

How to implement a unified digital parts platform

The operating model relies on a back-end distributed commerce platform that works behind any front-end experience.

Think of it as the bridge between supply sources and demand channels — a single source of truth for all commerce operations.

The platform enables manufacturers to:

Centralize OEM-grade product and fitment data from existing PIM and ERP systems.

Onboard dealers quickly with streamlined workflows and governance. They will publish offers against the OEM-grade catalog, including price, inventory and lead times.

Create seamless buyer experience by pushing accurate catalog, availability, pricing and delivery estimates to the front-end experience, while supporting complete checkout and payment so buyers can place orders, not just browse.

Automatically route orders to the optimal fulfiller based on inventory, territory, SLA and margin rules. Provide intuitive dealer and warehouse portals to accept, fulfill and update order status.

Feed real-time order status and tracking back to the front end for consistent buyer experiences.

This creates a true win-win-win situation.

Customers get one trusted destination to discover and buy genuine parts and accessories for their equipment.

Dealers gain modern digital capabilities under the trusted OEM brand without infrastructure investment.

Meanwhile, manufacturers recapture valuable customer insights — search patterns, fitment queries, quote requests and purchase behaviors — that inform smarter product development, inventory allocation, pricing strategies and service level improvements.

Aftermarket digitization success stories

Companies implementing this approach are seeing impressive results.

Toyota Material Handling transformed their dealer locator into a comprehensive here-to-buy platform, unifying dealer inventories so customers could instantly see real-time availability and place orders directly. The results: 220% year-over-year growth in online parts sales and 30% month-over-month GMV increases.

Airbus Helicopters expanded beyond genuine parts to include carefully vetted third-party suppliers, creating a true one-stop destination that cut product lead times to 24-48 hours while substantially reducing aircraft downtime.

Aniel built a comprehensive platform serving 8,500 auto body shop clients with 160 curated third-party sellers, achieving 30% growth while expanding to tens of millions of product listings.

These examples point to a clear path forward: create a unified here-to-buy destination, enable full transactions, orchestrate fulfillment to the best dealer or OEM node and use first-party signals to continuously refine assortment, pricing and service levels.

To learn more about top trends in the aftermarket industry, download our latest ebook here.

Download the ebook: Top 5 Trends in the Aftermarket Industry