Building a high-performance, sustainable retail media program (Part 1)

Part 1 | Field-tested foundations for retailers

This series is based on my operational experience — primarily at Cdiscount, a pioneer of retail media in France. Every retail context is unique, so my goal isn't to deliver universal truths. Instead, I'm sharing practical, battle-tested guidance you can apply to build a retail media program that drives real results.

As VP of Product for Mirakl Ads, I've seen firsthand how retailers of all sizes can capture sustainable value from retail media. Whether you're just starting to explore monetization or looking to optimize an existing program, the principles and frameworks in this series will help you navigate the journey with confidence.

The opportunity: Building monetization programs that work for everyone

The objective is clear: enable any retailer to build a monetization program that benefits end customers, brands and sellers — without ceding all the value to platforms like Amazon or Walmart.

Cdiscount's journey illustrates what's possible. We grew from €0 to more than €73 million in seven years on retail media including sponsored products, long before "retail media" became a buzzword. 1, 2, 3

Our success was driven by iteration, performance rigor and an unwavering focus on delivering value to all stakeholders. Growth remains strong, with +9% in Q2 2025.

So, why did a French player emerge so strongly in retail media?

The answer is a combination of several factors that aligned:

Critical mass: Cdiscount achieved Tier 1 scale, creating the audience reach advertisers demand.

Rapid, large-scale marketplace opening: A broad seller base generated diverse inventory and advertising opportunities.

Very open, non-curated seller model: This approach maximized selection and created consistent demand for visibility.

"Best price" DNA and ancillary revenue history: With low margins and ad sales dating back to 2005, monetization was embedded in our strategy from the start

These lessons apply beyond Cdiscount.

For any retailer operating a marketplace or eCommerce platform, retail media represents a high-margin revenue stream that complements your core business while enhancing the customer experience — when executed correctly, that is.

Build sustainable success: A progressive, iterative journey

Building a high-performance retail media program isn't a one-time project. It's a collective endeavor that spans multiple disciplines and evolves over time.

No fluff here — just practical feedback so retailers can capture a fair, sustainable share of value while serving end customers, brands and sellers.

Retail media monetization is progressive and iterative by nature.

It involves internal teams across your organization (site/front-end, marketing, search, product/tech) and external partners (brands, sellers, agencies, customers). Success depends on coordination, transparency and shared objectives.

In this first part of our series I’ll focus on three critical foundations:

The core stakeholder groups and their objectives

The inherent tensions between these groups — and how to balance them

A preview of the maturity journey we'll detail in subsequent parts

Understanding these dynamics is essential before you can build a sustainable program.

Let's dive in.

Stakeholders objectives and how to balance tensions

Every retail media program must serve three primary stakeholder groups, each with distinct objectives and challenges. The key is understanding what drives each group and where their needs intersect — or conflict.

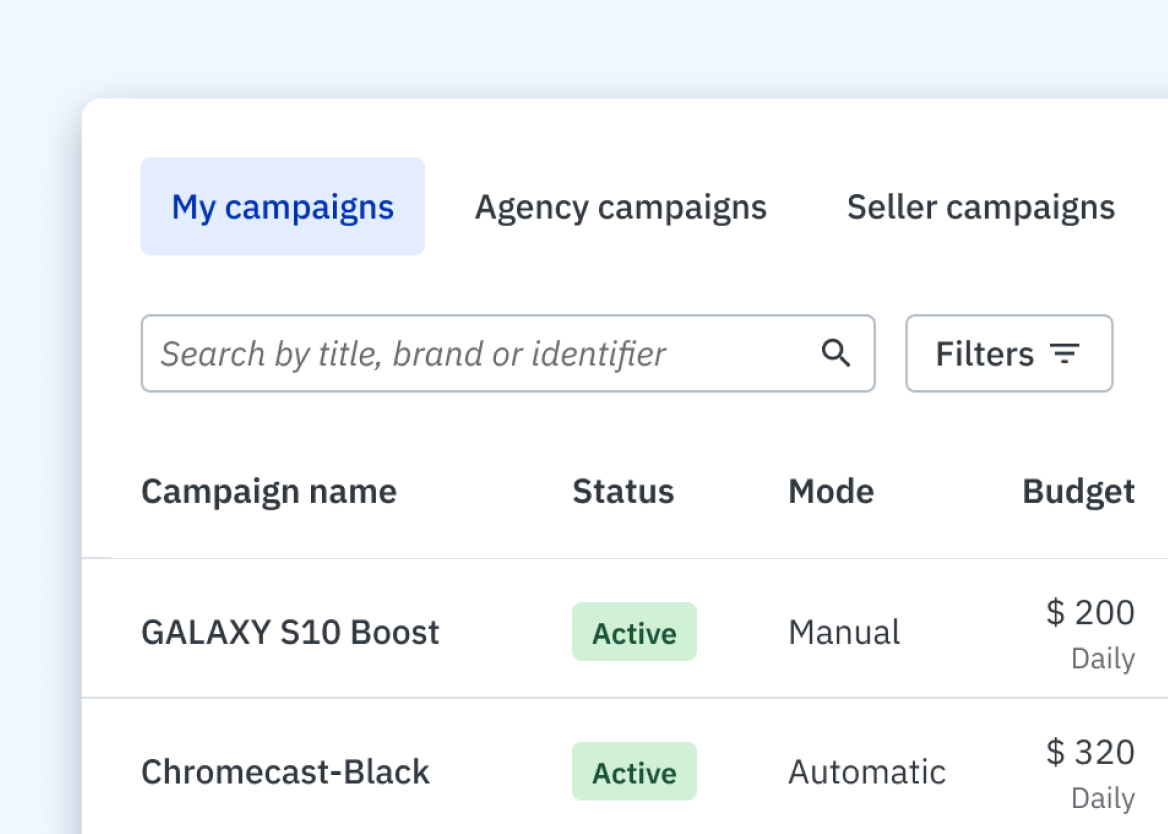

1. The sales house (ad operations)

Objectives: Maximize advertising revenue (on-site, data, services) and margin (revenue minus HR and tech costs) across endemic and non-endemic demand.

Challenges:

Build a clear, productized offering: Define your formats, inventory, pricing/floors and packages in a way that's easy for advertisers to understand and buy.

Decide sales coverage: Determine whether to build a specialized team or leverage your existing salesforce.

Professionalize operations: Establish robust processes for forecasting, pacing, fill rate management and ACOS/ROAS pressure.

The ad operations team is the revenue engine of your retail media program. Their success depends on having the right tools to manage inventory, optimize yield and demonstrate clear value to advertisers. Without strong operational foundations, even the best strategy will fail to scale.

2. End customers and the website

Objectives: Protect and improve the shopping experience.

Challenges:

Avoid ad overexposure and noise: Too many ads or poorly placed placements degrade the experience and drive customers away.

Ensure relevance: Ads must align with queries, categories and product quality standards.

Orchestrate with business rules: Balance competing priorities like first-party vs. third-party products and strategic categories.

Control critical placements: Protect high-value positions and manage perceived cannibalization of organic listings.

The customer experience is non-negotiable.

Retailers who prioritize short-term ad revenue at the expense of relevance and user satisfaction ultimately undermine both their brand and their retail media program.

The good news? Modern technology — particularly AI-powered solutions — can automate relevance targeting and protect the shopping experience at scale.

AI in retail media goes beyond basic automation to continuously learn from live data, ensuring ads remain contextually relevant while maximizing monetization opportunities.

3. Sellers and brands

Objectives: Grow GMV under margin and resource constraints.

Challenges:

Minimize activation and optimization effort: Advertisers need simple onboarding and intuitive campaign management.

Master ACOS/ROAS with transparent levers: Provide clear tools and reporting so advertisers understand what's working and why.

Prove value and provide clear management: Start with managed service support for new advertisers, then transition to guided autonomy as they gain confidence.

Sellers and brands are your customers in a retail media program. Their satisfaction directly impacts participation rates, campaign budgets and long-term retention.

Large brands need sophisticated campaign management capabilities with granular data for optimization.

Smaller advertisers require comprehensive automation that includes not just targeting and bidding, but also product selection — enabling them to launch impactful campaigns in under a minute.

For retailers operating on platforms like Mirakl, campaign budgets can be automatically deducted from seller balances, eliminating invoice management friction and accelerating adoption.

The core tension: Maximizing revenue without degrading experience

Here's the natural tension at the heart of every retail media program: Maximizing ad revenue and advertiser satisfaction without degrading customer experience.

This isn't a theoretical problem. It's the daily challenge that determines whether your program thrives or stalls.

The resolution lies in disciplined prioritization of the end user and product quality, coupled with transparent guardrails and measurable outcomes.

Specifically:

Focus on relevance: Only serve ads that align with shopper intent and context.

Establish clear controls: Use floor prices, placement management and targeted ACOS settings to balance revenue with experience.

Measure what matters: Track not just revenue metrics but also customer satisfaction indicators like click-through rates, conversion rates and return visitor behavior.

Iterate based on data: Use transparent reporting to understand what's working and adjust quickly.

When you get this balance right, everyone wins.

Customers discover relevant products, advertisers see strong ROAS and retailers capture high-margin revenue while strengthening their platform.

What's next: Understanding maturity levels

Building a sustainable retail media program is a journey, not a destination.

In Part 2 of this series, we'll explore the maturity framework that guides this journey — breaking down the key building blocks, metrics and levers for action at each stage.

You'll learn:

How to assess where your program stands today

What capabilities to prioritize as you scale

How to set realistic targets and measure progress

Which tools and processes to implement at each maturity level

Whether you're launching your first campaign or optimizing an established network, this framework will help you build strategically and scale sustainably.

If you're interested in understanding how AI can help you manage the complexity of balancing stakeholder needs while scaling your program, download our ebook: AI-powered retail media: How it works and why it wins.

Sources

https://www.cnova.com/wp-content/uploads/2024/10/Cnova-NV_Activity-Press-release_3Q24.pdf

https://www.cnova.com/wp-content/uploads/2024/07/Cnova-NV_Activity-Press-release_2Q24.pdf