How to build a high-performance, sustainable retail media program (Part 3)

In the first two parts of this series, we established the groundwork for retail media success.

In Part 1, we explored the foundational stakeholders and the inherent tensions that must be balanced to protect the customer experience. In Part 2, we mapped out the three levels of the retail media maturity journey, moving from initial pilot programs to more sophisticated operations.

As we move into this third installment, the conversation shifts from "why" and "where" to "how."

Specifically, how do you handle the structural and technical pressure that comes with rapid growth?

Part 3 | Organization, technology and data: What changes with scale

In the early days of a retail media program, agility is your greatest asset.

One or two "Swiss Army knife" employees often handle everything from sales and operations to basic reporting. But, as your program matures, this generalist approach becomes a bottleneck.

To move from Level 2 to Level 3 maturity, you must shift from simply managing a project to running a specialized business unit.

Organization: The shift to specialization

As you scale, the "one person does everything" model inevitably fails. You need a structure that mirrors the complexity of your ecosystem.

Specialized Roles

True scale requires dedicated experts in four key areas:

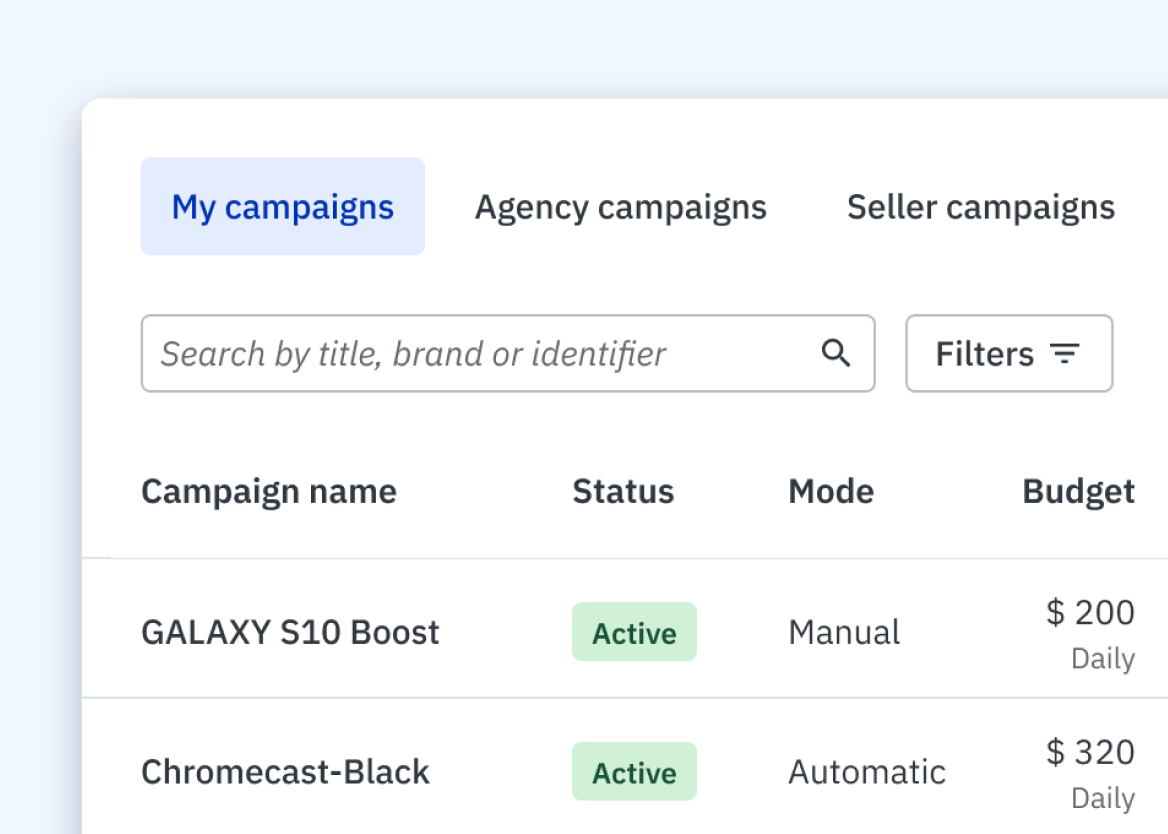

Sales: Segmented by brands (1P) and sellers (3P), as well as by category.

Trading and Ops: To create and optimize campaigns for managed services.

Yield Manager: To manage floor prices and inventory yield and new positions.

Analytics and BI: To turn raw data into actionable insights.

Retail media product: A dedicated bridge between commercial goals and technical feasibility.

Managing ecosystem complexity

One of the biggest organizational hurdles is clarifying "who sells what, to whom and how."

While 1P suppliers are typically managed by buyers, 3P sellers interact with account managers. Meanwhile, agencies are pushing for platform rationalization across their entire portfolio.

Without clear alignment between your buying and account management teams, you risk internal cannibalization and a confusing experience for your partners.

Technology: Serving commercial strategy

A common mistake is over-investing in "showcase" features — like sophisticated programmatic offsite or dynamic creative optimization (DCO) — too early.

Prioritize the core

In most high-performing programs, sponsored products drive approximately 63.6% of revenue.

Your technology stack must reflect this reality.

Tools should prioritize features that are actually used, scalable and customizable, with relevance/quality safeguards. As you grow, you must also automate Sales House optimization for small-to-medium campaigns to ensure they don't drain your team's manual resources.

The build vs. buy dilemma

When it comes to sponsored products, the decision to build in-house or buy a solution depends on your size and ambition.

From my perspective, if your ad spend is below €30 million, it is rarely worth building your own platform. The development costs and the high risk of misalignment with retailer priorities often outweigh the benefits.

Buying a scalable, adaptable solution allows you to focus on your commercial strategy rather than technical maintenance.

Data and reporting: From reassurance to action

Reporting must evolve from a "look back" at what happened to a "look forward" at what needs to be done.

The evolution of timeliness

In the beginning, monthly Excel reports are sufficient.

At scale, you move to proprietary BI (like Power BI, Tableau, or Data Studio), eventually reaching near-real-time API analytics.

Depending on the criticality of the decision, your data cadence must move from month to week, then day, hours, and finally to bid-level instant data for advanced trading. But, it’s important to reiterate, that before you can achieve bid-level data insights, you must first master intraday dynamics.

Shared KPI definitions

To speed up decision-making, every team must use the same definitions.

If the Sales team and the Ops team have different ideas of what constitutes a "successful" advertising cost of sales (ACOS), you will face constant friction.

Reporting frameworks by maturity level

Level 1 (macro management): Focus on global fill rate, global total advertising cost of sales (TACOS) and identifying top non-spending GMV products.

Level 2 (structuring): Track delivery pacing and fill rate per category (ordered by organic GMV potential). Identify where you need more slots.

Level 3 (specialization): Advanced governance of top positions, under-budgeted campaigns (identifying midday cuts), keyword pressure and bid floor gaps.

Overcoming common frictions

Scaling often meets internal resistance. Here is how to address the most common objections.

Objection: "Top positions should never be open to sponsored ads."

The reality: Without strict eligibility and organic/sponsored delta measurement, it is risky; with them, you create real customer and business value.

Objection: "Don't let sellers set their own ACOS targets; they’ll set them too low and our spend will drop."

The reality: Guided autonomy actually unlocks growth. By providing guardrails like bid floors and quality gates alongside performance recommendations, you empower sellers to spend more confidently.

Objection: "We should stay closed to the ecosystem to maintain control."

The reality: Controlled openness to agencies and third-party tools multiplies demand and expertise. Standardize access while maintaining your quality rules to scale faster.

The future: The platform as an operational copilot

What if your platform didn't just show you data, but guided you step-by-step?

Instead of a retailer checking "RFP boxes," the platform should act as an operational copilot at each maturity stage. The goal is to move beyond passive dashboards and into an orchestration layer that lives above your analytics.

This shift happens when the platform begins to synthesize the specialized data and organizational roles we’ve discussed — turning every raw insight into an assignable, trackable and measurable task.

To achieve this level of maturity, we look at the four specific pillars that transform a platform from a reporting tool into an action-oriented engine.

The 4 pillars of action-oriented orchestration

Opportunity and alert detection: Automatically flagging "Top GMV with no spend" (L1), "High-potential categories" (L2) or "Gaps in Bid vs. Paid CPC" (L3).

Contextualized next-best actions (NBAs): The platform should tell the Sales House: "Brand X: Add €500/day in Category Y to capture a projected €35,000 in monthly GMV." It should tell Trading: "Increase budget Z by 20% to avoid a midday cut."

Routing by role: The platform "knows" who does what based on your organizational structure. It assigns budget tasks to Sales, slot tests to Product and eligibility rules to the Site team, each with a specific deadline and status.

Closed-loop learning: Each action is measured against its expected impact. If a post-4:00 PM budget increase consistently yields a 1.4x ROI in Category B, the system learns from that success and prioritizes similar actions in the future.

Orchestrating sustainable growth at scale

Scaling a retail media program is about moving from "what happened?" to "what should we do next?"

When you align your organization, technology and data around action, you create a program that is not just high-performing, but truly sustainable.

In the final part of this series, we will put everything together and look at the "platform views by maturity."

We’ll step inside the cockpit to see how the dashboard evolves at each level — from simple macro-management cards to the "business unlock board" that uses AI-driven recommendations to drive SKU-level precision.

We will close by exploring how daily workflows shift for different roles, showing how the art of retail media orchestration looks in practice for everyone from the sales lead to the platform engineer.