Building a high-performance, sustainable retail media program (Part 2)

Part 2 | The maturity journey: From initiation to advanced orchestration

In Part 1 of this series, we explored the three core stakeholders of any retail media program: the Sales House, the Website team, and the Brands/Sellers. We established that a successful program isn't just about maximizing revenue — it’s about balancing that revenue with a high-quality customer experience and sustainable seller growth.

But how do you move from a "pilot" phase to a professionalized, high-scale engine?

Building a retail media program is a journey, not a switch you flip. Based on my experience — from the early days at Cdiscount to stepping in as the VP of Product for Mirakl Ads — I’ve found that maturity isn’t defined by a single number. It is a set of signals across team size, data mastery and the technical sophistication of your ad slots.

In this second part, we’ll break down the three levels of retail media maturity and provide the "battle-tested" checklist for navigating each stage.

Understanding maturity: The signals

Rather than looking at fixed levels, I advise retailers to watch for specific signals that indicate it’s time to move to the next stage of sophistication. You can accomplish that by asking yourself the following questions around these relevant subjects:

Program size: Are you generating €1 million, €10 million, or €100 million?

The media mix: Is your revenue 80% legacy trade marketing and 20% retail media, or have you flipped that to 20/80?

Ad inventory: Do you have 1–3 top positions on search result pages, or have you expanded to 7+ placements?

Data mastery: Can you track advertising cost of sales (ACOS) at the SKU level? Do you understand your total advertising cost of sales (TACOS)?

Why TACOS matters

That last question is important enough to warrant an aside. That’s because as your program matures, your math must change.

In the early days of any retail media program, your focus should be on ACOS (Spend / Ad GMV). Here, it’s important to note that, during this time, you should find and follow industry standards with regards to your ACOS calculation. It’s the only way to remain relevant to your sellers and brands, vs using a non-standard definition.

That said, by the time you reach a Level 3 maturity level (as you’ll see below), you should be looking at the bigger picture: TACOS = (Adslots × Fill Rate × CTR × CPC) / (Organic GMV + Ad GMV).

At this stage, you must also split first party (1P) and third party (3P) ads in your analytics.

Why?

Because 1P typically has higher conversion rates (CVR) and costs-per-click (CPCs). If you average them out to set your floor prices, you’ll likely set the floor too high and kill your 3P competition.

Level 1: Initiation and proof (getting started)

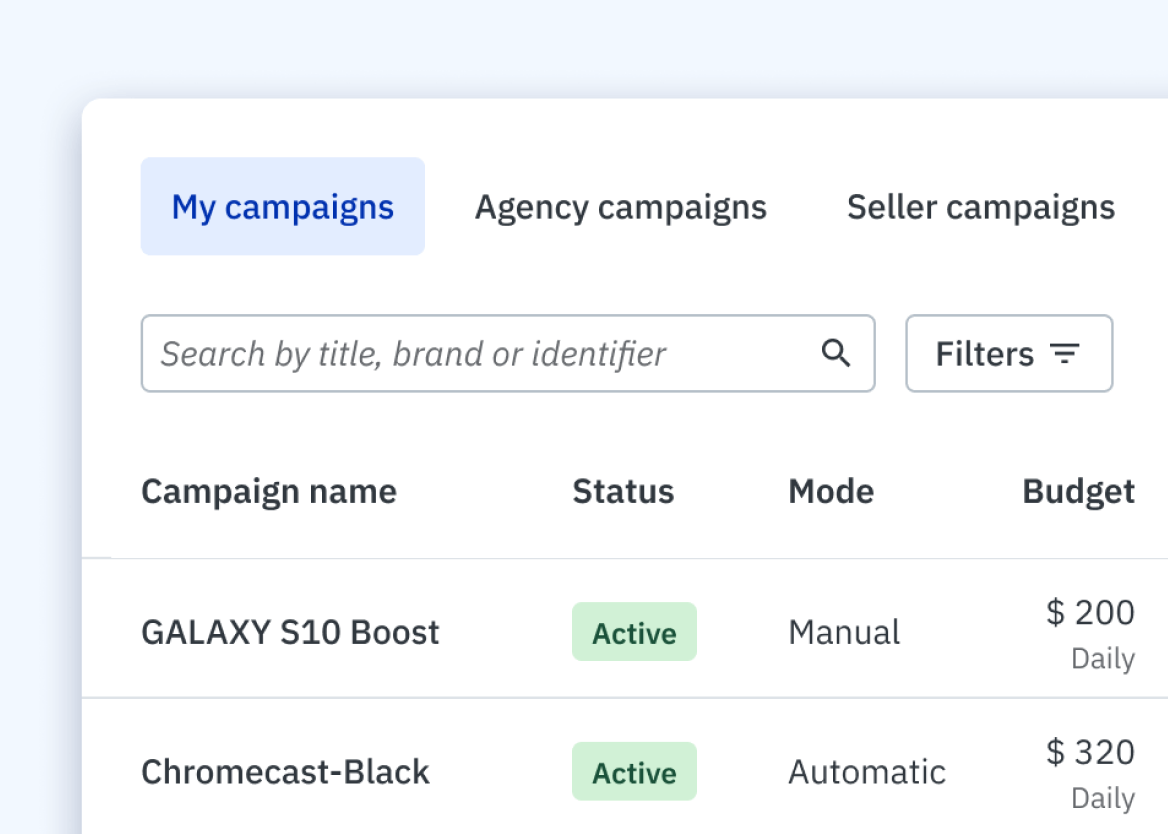

At Level 1, your program is in its infancy. This is where you’ll select a technology partner, assemble an agile core team, and will finally start seeing those first trickles of revenue.

This is a stage characterized by "ups and downs" as you find your rhythm, and your primary goal is simply to prove that the model works without breaking the core business. To find success at Level 1 and advance to Level 2 you’ll want to focus on lowering the friction in the sales house, gaining acceptance within your site and customer experiences, and concentrate on ACOS as the basic metric for understanding campaign performance.

The sales house: Lowering the friction

Your focus here should be on the "low-hanging fruit" — top-tier brands and mature sellers who are already familiar with the mechanics of sponsored products. Keep in mind that many advertisers are initially reluctant to invest time in a new retail media network; they see it as time-consuming with limited immediate potential.

To overcome this, your sales house must act as a "light managed" service. Offer free vouchers to encourage testing and keep your pricing and floor levels modest. You are building a "profitable playground" for advertisers; if they see early success with minimal effort, they will stay for the long haul.

Site and customer experience: Gaining acceptance

For the website team, Level 1 is a period of cautious experimentation. You must prioritize basic relevance over aggressive monetization. This means ensuring simple query-product matching, such as making sure a search for "cream" doesn't return face cream in the fresh dairy section.

At this stage, more formats are not the answer. If your fill rate is low, adding more ad slots will only result in "empty" space or irrelevant noise that degrades the customer journey. Every ad served should be a tool for growth, not a problem for the user experience.

Level 1 KPIs and milestones

At Level 1, your focus will be on proving viability and establishing a baseline. Key metrics include:

Target ACOS: Monitor by category and actor type (1P / 3P).

Global fill rate: Track the percentage of available ad inventory that is utilized.

Basic ad performance: Monitor Click-Through Rate (CTR) and CPC.

Daily revenue: Establish and track initial revenue targets.

Onboarding: Successfully onboard your top N brands/sellers.

Target seller-side TACOS: Aim for a seller-side TACOS of ~0–1% at launch, representing a healthy, low-pressure start that proves the program's viability to your internal stakeholders.

To-do for Level 1

Before you can consider yourself at Level 2, there are a few to-do list items you’ll want to check off. Those include:

[ ] Limit formats: Focus on 1 or 2 high-impact ad slots to prove relevance.

[ ] Targeted onboarding: Bring on your top "N" brands using managed services to ensure their first campaigns are successful.

[ ] Daily vigilance: Monitor revenue and fill rate daily to catch and fix technical "ups and downs" quickly.

Level 2: Growth and structuring (scaling up)

Level 2 is where the program begins to mature from a "side project" into a structured business unit.

You’ve proven the value; now it’s time to move from "reassuring reporting" (simply showing that revenue exists) to "action-triggering reporting" (identifying exactly where growth is being throttled).

At this stage, your fill rate is climbing, competition is heating up and it’s time to increase your ad surface. This requires mastering the intraday dynamics of your sales house, tightening quality thresholds for your site and customer experiences, and adding additional value for your sellers and brands.

The sales house: Mastering the intra-day dynamics

Now, the team must go deeper. It’s no longer just about the top 10 sellers; you need to look at the "mid-tail."

One of the most common revenue leaks at this stage is the “midday cut.” You will see campaigns that are highly performant but deactivate by 2PM, for example, because their daily budget was too small.

This is pure opportunity loss.

Furthermore, you must become proactive during peak periods. There is a "peak period paradox" I often saw during events like Black Friday: spend rises, but the relative investment rate often falls because traffic is driven by organic "deals" outside of campaigns.

To win here, the sales house needs "event playbooks" that anticipate these deals and provide SKU-level recommendations to brands weeks in advance.

Site and customer experience: Performance equity

As you move into high-value top positions, the "relevancy gate" becomes your best friend.

You must establish strict quality thresholds: If a product has a high price index, poor reviews or is frequently out of stock, it shouldn't occupy a premium ad slot, regardless of the bid.

Here, you’re balancing immediate gain against the long-term health of the customer experience.

Sellers and brands: Building competence

This is the moment to shift from "we do it for you" to "we help you do it better."

Move your mature players into guided self-service. Provide them with the insights they can't get elsewhere — like average ACOS for their specific category.

When you show a seller that their budget is cutting out while demand is still high, you aren't just selling more ads; you're providing a strategic growth lever.

Level 2 KPIs and milestones

At Level 2, your focus shifts from simply proving viability to maximizing efficiency and establishing clear growth trajectories. Key metrics and milestones include:

Category-level performance: Track fill rate, Click-Through Rate (CTR), CPC, ACOS pressure, and the ratio of organic vs. ad Gross Merchandise Value (GMV) by category. This identifies high-potential categories (those with high organic GMV but low ad pressure/fill rate).

Ad slot expansion plan: Formalize a plan for adding new ad slots, ensuring each addition is backed by data proving high fill rates and positive customer acceptance/User Experience (UX).

Campaign budget management: Implement processes to manage and proactively address "midday cut" campaigns — those that deactivate early due to insufficient daily budgets, representing a loss of revenue opportunity.

To-do for Level 2:

Graduating from Level 2 to Level 3 means checking off the following items:

[ ] Category dashboards: Track fill rate, CTR and TACOS by category to identify high-potential "pockets" where organic gross merchandise value (GMV) is high, but ad pressure is low.

[ ] Event playbooks: Industrialize your approach to major sales events, focusing on SKU integration and budget pacing.

[ ] Data-driven expansion: Add new ad slots only when you have data-backed proof of high fill rates and a stable customer user experience (UX).

Level 3: Professionalization and specialization (The Master Class)

At Level 3, the discipline of retail media moves from an operational task to a scientific one.

You have high competition, high demand and even higher stakes.

At this stage, your focus shifts to optimizing architecture, ensuring fairness and scaling via advanced technical orchestration. You aren't just balancing revenue; you are protecting the integrity of your entire marketplace.

To find success at Level 3 you’ll need to master dynamic pricing, meticulously measure advanced KPIs like your “organic vs. sponsored delta”, and be able to provide SKU-level recommendations.

The sales house: Advanced orchestration

The sales house must now master dynamic pricing. This involves setting floors by category and seasonality and monitoring for "pressure loss" — instances where bids consistently fall below your floor.

You should also be tracking the "bid vs. paid CPC" gap. If the gap is too wide, your floors are inefficient; if it's too narrow, you're leaving money on the table.

Beyond pricing, you must move toward "always-on" coverage guided by strict ACOS constraints.

The goal at this level is to smooth out daily cash injections and eliminate the outliers that skew your data.

Site and customer experience: Quality before quantity

At Level 3, "advanced eligibility" is mandatory.

You must scientifically measure the organic vs. sponsored delta — the exact change in conversion rate and GMV when a premium slot is activated. If the ad cannibalizes too much organic revenue or provides a net negative customer benefit, it must be blocked.

This is also where you manage "keyword pressure," ensuring that short-tail and long-tail keywords are balanced to prevent a monopoly of visibility by a few top spenders.

Sellers and brands: Sustainable performance

For your advertisers, Level 3 is about surgical precision.

You should be providing SKU-level recommendations that integrate uncovered top SKUs.

Instead of saying "spend more," tell your advertisers exactly where their spend should go: "If you add these 25 high-conversion SKUs that currently have zero ad visibility, and set a target ACOS of 12%, our models project an incremental €35,000 in monthly GMV."

This is also where controlled automation (bidding and pacing) becomes the standard, but it must be paired with total transparency regarding bid vs. paid CPC.

Level 3 KPIs and milestones

At Level 3, the focus moves from efficiency to scientific optimization, ensuring market fairness and sustainable growth through technical mastery. Key metrics and milestones include:

Financial Arbitrage: Track TACOS (by category/actor) and ACOS/GMV arbitrage for profitable spend.

Auction Efficiency: Monitor keyword pressure, top keyword fill rate, and Bid vs. Paid CPC gap to optimize auction mechanics.

Experience Governance: Govern First Position access, tracking net client benefit and cannibalization to protect organic revenue and user experience.

To-do for Level 3:

Mastering Level 3 means your retail media program has reached full maturity. That means being able to check off the following:

[ ] Advanced eligibility: Implement automated blocks for products with uncompetitive prices, low reviews or poor seller ratings.

[ ] First position governance: Establish clear access conditions and monitor the cannibalization control delta for all top-of-page placements.

[ ] AI-driven orchestration: Deploy SKU-level budget and bidding recommendations to turn raw insights into automated, actionable next steps.

The bottom line: Trust is the engine

The ability to master these components — both analytically and operationally — is what determines the maturity of your program. But remember: technology is just the enabler.

The real secret to moving from Level 1 to Level 3 is trust.

The sales house must trust the website team to protect the site; the sellers must trust the data you provide; and the customers must trust that your "sponsored" products are actually relevant to their needs.

In part 3 of this series, we’ll explore what really changes as retail media scales across organization, technology and data: moving from “one person does everything” to clear specialization and ownership, and ensuring tools and feature investments match the commercial reality (with sponsored products still driving the bulk of revenue).

We’ll also look at how reporting must evolve from Excel-style “reassurance” to near-real-time, action-triggering decision support with shared KPI definitions and tighter operating cadence.

Finally, we’ll outline a step-by-step vision for a platform that acts as an operational copilot by detecting opportunities, recommending next-best actions, routing them to the right roles and closing the loop with measurable impact.

Download our eBook: AI-powered Retail Media: How it works and why it wins.