Unlocking new revenue streams: 5 retail media ad experiences we love

Retail media networks are projected to grow into a $100 billion market by 2026, with profit margins as high as 70-90% for retailers. But the real question is, what does success look like in practice?

Below, we highlight five retail and commerce media ad examples that demonstrate the range of on-site advertising opportunities, in-store activations, and offsite partnerships available today. Each shows how retailers are monetizing ad inventory more effectively and boosting retail media network profitability while still delivering value to shoppers and brands.

1. Stop & Shop Savings Stations: Bringing retail media in-store

Stop & Shop introduced Savings Stations, in-store digital coupon kiosks designed to reach “digitally hesitant” shoppers, including seniors and lower-income households.

Loading...

The strategy behind it:

Expanding reach: Extends retail media into the physical store, tapping into audiences unlikely to engage with mobile or eCommerce campaigns.

Bridging digital + physical: Creates a measurable ad channel within the store environment.

Incremental budgets: Unlocks brand investment aimed at harder-to-reach segments.

The upside for retailers: In-store kiosks diversify monetization beyond digital screens, proving that retail media ad examples aren’t limited to eCommerce. By monetizing ad inventory in physical spaces, retailers capture incremental spend and drive retail media network profitability.

2. PayPal Offsite Ads: Extending commerce media across the web

PayPal Ads leverages its transaction graph and shopper insights to deliver offsite ads across the open web and apps, helping brands reach high-intent audiences beyond retailer-owned sites.

Loading...

The strategy behind it:

Closed-loop measurement: Ties offsite engagement directly to purchase outcomes.

Incremental reach: Extends campaigns into discovery and consideration phases, not just purchase.

Trust and scale: Anchored by PayPal’s network of 435M+ active users and billions of shopping signals.

The upside for retailers: Offsite activations allow networks to monetize ad inventory outside their own platforms, expanding the revenue pool. For brands, this provides consistent shopper engagement across channels, proving the value of partnerships that go beyond on-site advertising opportunities and strengthen retail media network profitability.

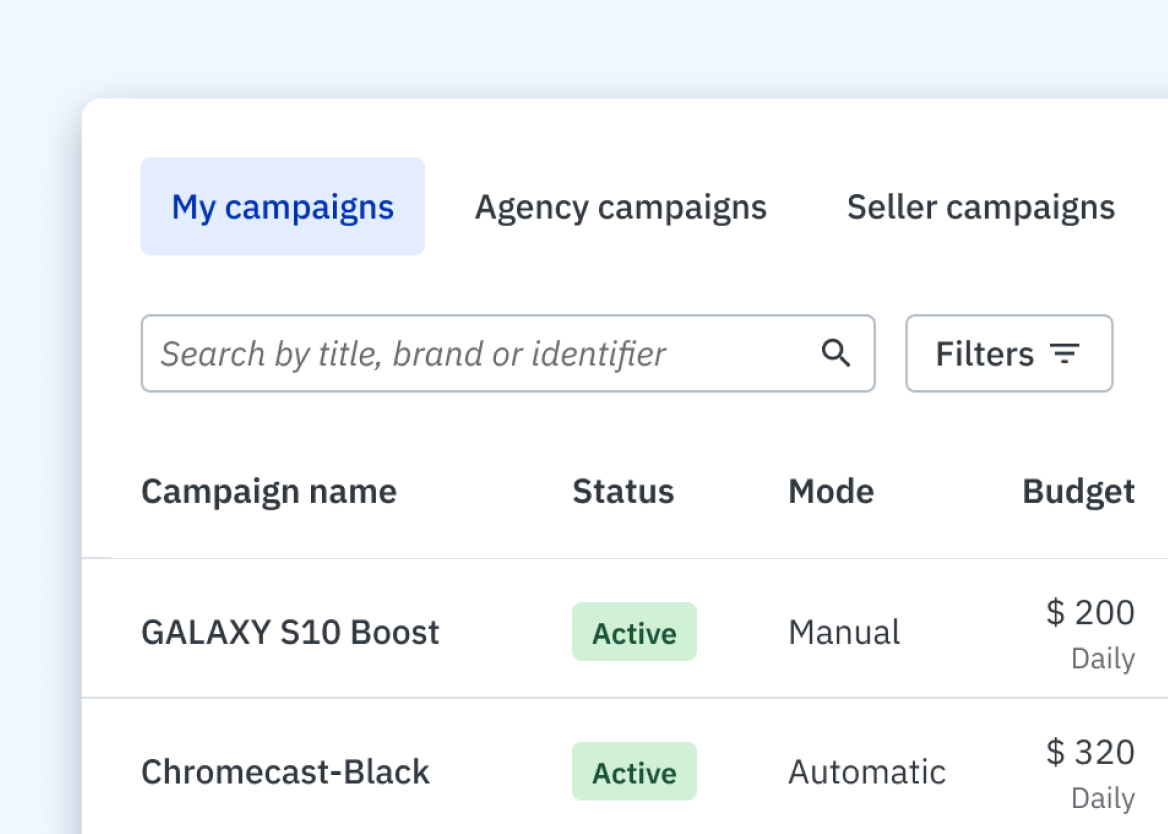

3. Kroger Precision Marketing: Sponsored product listings at scale

Kroger Precision Marketing (KPM) demonstrated the power of sponsored product listings by tying on-site ads to incremental sales at scale, giving brands a measurable path to ROI. Indeed, advertisers saw as much as an 11% incremental sales lift among exposed households and a 4:1 return on ad spend (ROAS).

Loading...

The strategy behind it:

First-party data monetization: Leverages Kroger’s purchase data to serve highly relevant sponsored product listings.

Performance focus: Demonstrates closed-loop attribution by linking ad exposure to actual in-store and online sales.

Scalable self-serve: Allows brands of all sizes to participate, ensuring no wasted inventory.

The upside for retailers: Sponsored product listings are the backbone of on-site advertising opportunities. They deliver consistent, repeatable revenue streams and are among the most profitable formats for monetizing ad inventory while preserving a seamless shopper experience.

4. Walmart Connect + Jif: Above-the-fold visibility that commands brand budgets

Walmart Connect worked with J.M. Smucker’s Jif brand on a back-to-school campaign featuring a Homepage Feature (above-the-fold, high-visibility display) paired with offsite display retargeting ads.

Loading...

The strategy behind it:

Premium placement: Homepage, top-of-page ads deliver maximum brand exposure.

Cross-format execution: Combined with onsite display and offsite retargeting for a full-funnel approach.

Budget unlock: Attracts investment from brand-building budgets that might otherwise flow to social or CTV.

The upside for retailers: Above-the-fold display ads monetize premium digital real estate with high margins. They show that retail media network profitability is boosted by packaging high-impact placements that brands will pay a premium to secure.

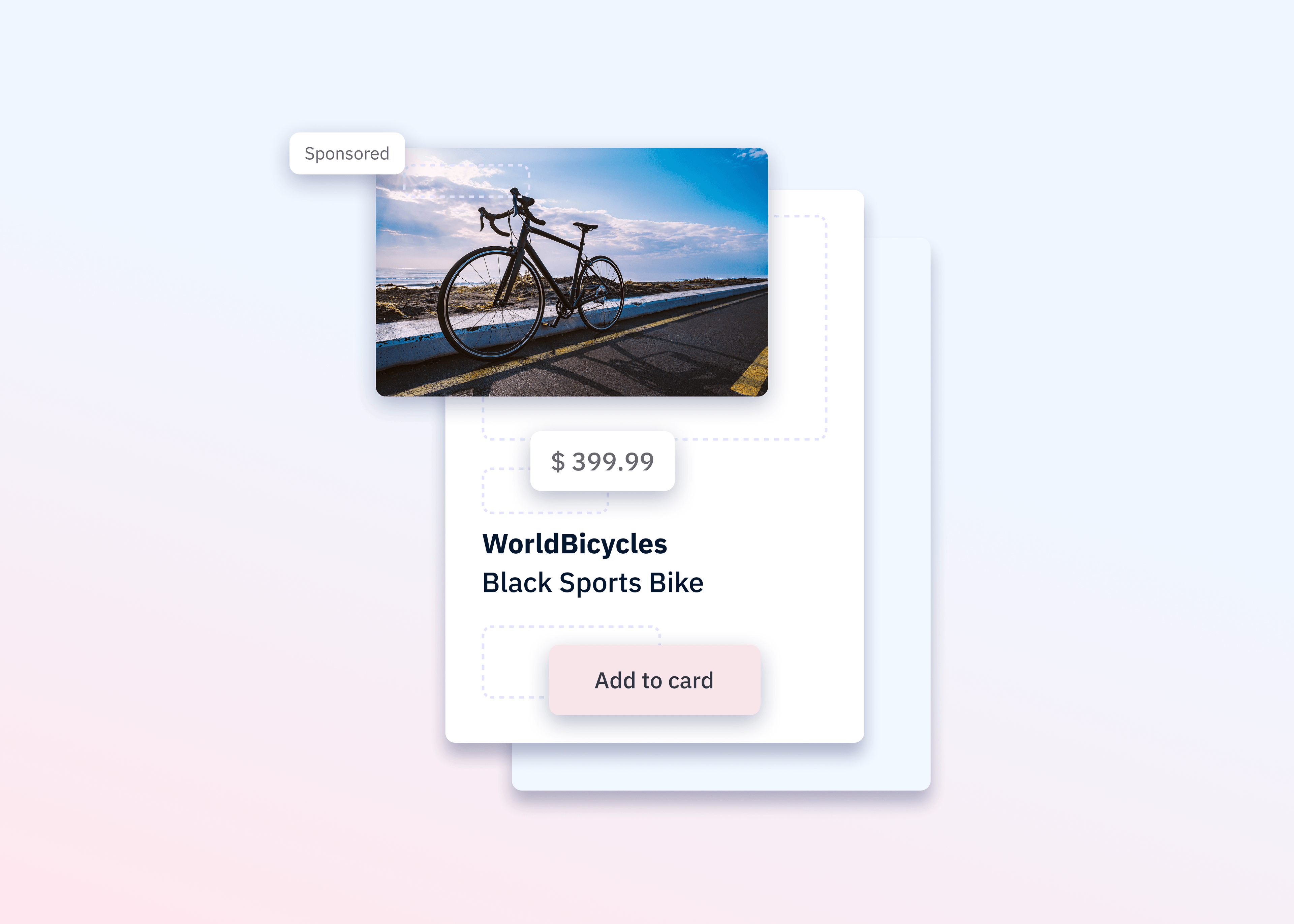

5. Symbiosis + Google Shopping: Monetizing leftover budgets with offsite reach

Symbiosis partnered with Rakuten to extend advertiser demand into Google Shopping and other offsite channels, ensuring budgets not absorbed by on-site sponsored placements were still activated.

The strategy behind it:

Partnership-driven monetization: Symbiosis helped Rakuten capture incremental budgets by extending its reach across Google.

Reducing CAC: Offsite ads drove quality traffic back to Rakuten while reducing customer acquisition costs.

Profit expansion: No need to create new campaigns, already launched campaigns deliver both on-site and offsite.

The upside for retailers: Partnerships like Symbiosis show that monetizing ad inventory doesn’t stop at the owned site. By building bridges to offsite ecosystems, retailers can unlock new pools of demand and expand retail media network profitability.

The bottom line

By studying the cutting edge of innovation in retail media, retailers can learn how to:

Monetize ad inventory across onsite, offsite, and in-store channels

Use sponsored product listings and above-the-fold placements as proven on-site advertising opportunities

Leverage data and partnerships to extend reach and capture incremental budgets

Build retail media network profitability without compromising the shopper experience

For retailers, your digital and physical real estate can be transformed into a powerful profit center when supported by the right strategy and infrastructure.